Latest rate hike shows an easing of the gas pedal

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for 4 weeks then price increases to the regular rate of $19.00 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.75/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 31/10/2022 (1134 days ago), so information in it may no longer be current.

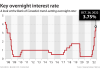

Bank of Canada Governor Tiff Macklem last week relaxed the pressure on the financial brake pedal he had been stomping on most of this year. Instead of raising the bank’s key interest rate by three-quarters of a percentage point, he raised it by just half a point to 3.75 per cent. It was his sixth successive interest rate hike this year.

Following rate hikes of a full percentage point in July and three-quarters of a point in September, the October move suggested that Governor Macklem was less anxious about inflation last week than he had been back in the summer.

The relatively modest October move suggested that the end of rapid rate rises might be in sight — not the end of high interest rates, just the end of rapid increases.

The Federal Reserve Board in the United States will be heard from this week when their turn comes to adjust interest rates. Since they are watching the same inflation and employment data, they may also conclude, like the Canadian central bankers, that they still have to crank up rates but not quite so rapidly as before.

Interest rates dictated in Ottawa, Washington and other capitals are economic abstractions, not aimed at anyone in particular. They make no direct difference to people who are neither borrowing nor lending money. For any business with large debts, however, or for any family that has recently bought or renovated a house or considered financing purchase of a car, these distant decisions can have drastic consequences.

Before the current period of high rates is over, some firms will be driven out of business, some families will have to sell their houses or cancel their vacation plans and some will have to continue driving for a couple more years the old car they were hoping to replace.

They will make these sacrifices in the interest of price stability. As long as inflation is running well above the central bankers’ target of two per cent a year, the bankers will keep throwing the barrier of high interest rates in front of prospective borrowers. This is supposed to remove some bidders from all markets, reduce upward pressure on prices and thereby protect the purchasing power of the national currency.

PATRICK DOYLE / CANADIAN PRESS FILES Bank of Canada governor Tiff Macklem

The links between cause and effect in this process are, however, tenuous, mysterious and slow. The central bankers are relying on information they collected over the last few months before the latest couple of rate-setting decisions. They will not see results of the October rate increase until early next year. By then they may find that they have plunged Canada and other industrial economies into a recession they never intended.

Governor Macklem reasons that it is better to clamp down hard on inflation by means of interest rate increases rather than sit back and hope for the best. If inflation is allowed to continue, then Canadians will come to expect further inflation next year and on into the indefinite future. Then much more severe interest rate hikes will be needed to stop the upward spiral.

Unfortunately there is a large element of guesswork in the inflation-fighting art. Prime Minister Justin Trudeau does not know how to curb inflation. He is leaving it to Tiff Macklem. Governor Macklem doesn’t actually know, either, but his job is to create the appearance that he is dealing with the problem. If he can convince Canadians that he knows what he is doing, prices may stabilize in another year or two.