It pays to put off collecting your Canada pension Locally created website shows you how much more you'll get the longer you delay

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for 4 weeks then price increases to the regular rate of $19.00 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.75/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 20/08/2020 (1937 days ago), so information in it may no longer be current.

Like most 77-year-olds, after winding down a long-time family business that included a year-long demolition project, Elliot Rodin decided to start a new on-line business.

It required the creation of sophisticated equations and could help Canadians earn as much as $100,000 in additional funds from their government pensions, so, nothing too complicated.

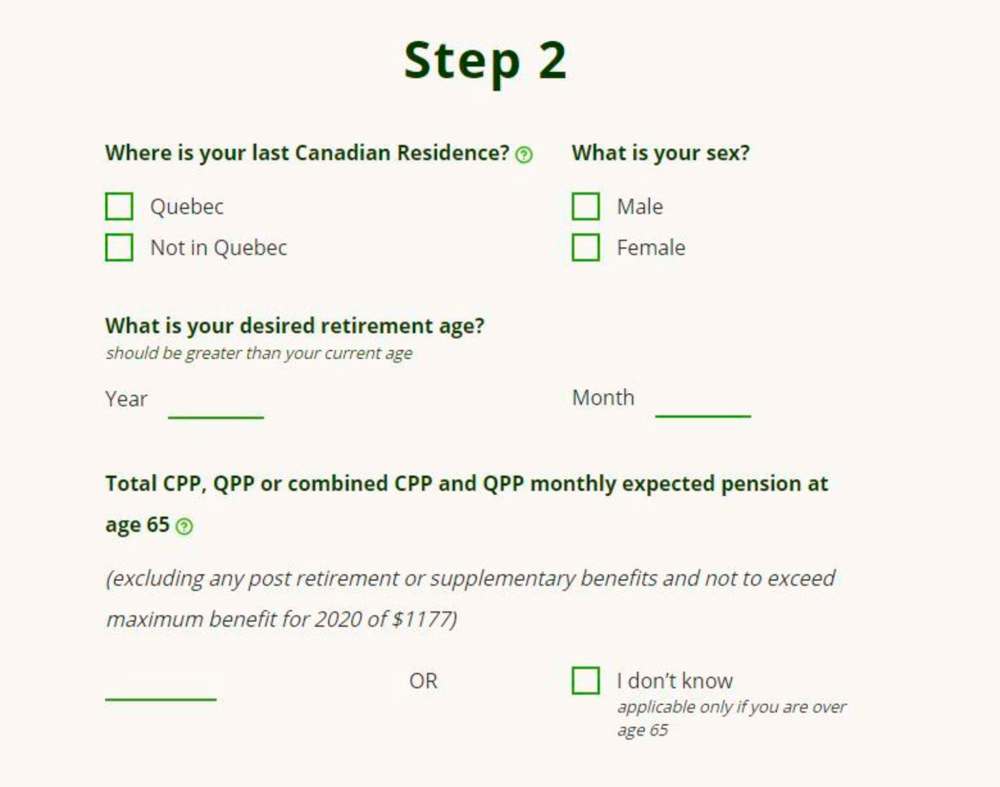

The website, HelpYouRetire.ca recently went live. Rodin has figured out the obscure mathematical formulas that lets people key in a modest amount of information and find out what their Canada Pension Plan, Quebec Pension Plan and Old Age Security benefits would be if they delayed the start of receiving their pension benefits by six months or a year or longer.

It’s not a problem Rodin has been distracted by all his life. After finishing up the demolition of Central Grain Co. Ltd. — the large grain elevator complex that was at the corner of Archibald Street and Provencher Boulevard — he happened across an article that said that 90 per cent of Americans didn’t start their retirement benefits at the right time.

He looked at the data and found that Canadians were also leaving a lot of money on the table.

In his prior life, Rodin was also a money manager and has plenty of training as an analyst, having worked for 13 years as a portfolio manager and securities analyst for Investors Group before he went to work for the family business.

“I’m basically going back to my roots,” he said. “I thought I could solve a problem and I didn’t see any other solutions out there. I genuinely want to help Canadians and I think I have something unique here.”

Knowing that his target market is people 58 to 68 years old he’s holding off spending on digital marketing and he made sure the website was simple and easy to use and not clouded with verbiage that turn people off.

The site will give users a basic dollar figure that could be gained in delaying receiving benefits for a year for each year up to age 70 at no cost.

A detailed analysis with numerical and bar charts and further detailed explanations for CPP and QPP costs $49.00, $39.00 for OAS and $65.00 for the two combined.

Rodin said the intention was to be as honest and straightforward as possible. He makes it clear that his analysis will not benefit everyone. For instance, people who are sick or in poor health should not bother with his analysis and his OAS for people on survivors pension will also not be helpful.

But on a basic level, the formula shows that for every month after age 65 that people delay beginning their CPP payments it will mean an additional 0.7 per cent in benefits. So if you wait six months past your 65th birthday to start collecting benefits it will mean an individual will collect an additional 4.2 per cent of income for the rest of his or her life.

“Government pensions can become one of the most significant retirement assets, worth $300,000-to-$400,000 — equivalent to the value of a home,” Rodin pointed out as a reason for people to make sure they can maximize its value.

“It will obviously vary by individual depending on their pension entitlement and years of residence in Canada… so it’s just a ballpark number, but the total value of waiting until age 70 could easily be worth as much as $50,000-to-$100,000.“

Using a web design firm and coders from Ottawa, Rodin did everything else himself. Although he’s not dependent on revenue from the site for his own retirement he is also careful about sharing his secrets and has not invited professional pension advisors to become familiar with the inner workings of his website.

“I’m hoping professional advisors will find it a useful thing to incorporate into their programs,” he said.

But he did feel good that he was on the right track after the release a couple of months ago of a paper by the Canadian Institute of Actuaries that addresses some of the same issues, called “The CPP Take-Up Decision: Risk and Opportunities.”

In a recent article in the Globe and Mail, one of the authors of the paper, Bonnie-Jeanne MacDonald, the director of financial security research at the National Institute on Ageing at Ryerson University, wrote, “People love these programs (CPP and QPP) because they’re simple: automatically pay contributions while you work, along with your employer; then, in retirement, collect the benefits earned until you die… However, underneath that outward simplicity lies a complicated financial system. That complexity includes generous financial incentives to delay the start of CPP — or QPP — payments.”

After reading the 40-page paper Rodin is confident he didn’t miss a thing.

martin.cash@freepress.mb.ca

Martin Cash has been writing a column and business news at the Free Press since 1989. Over those years he’s written through a number of business cycles and the rise and fall (and rise) in fortunes of many local businesses.

Our newsroom depends on a growing audience of readers to power our journalism. If you are not a paid reader, please consider becoming a subscriber.

Our newsroom depends on its audience of readers to power our journalism. Thank you for your support.