A $23,000 condo? Yeah, Winnipeg’s got that Owner believes Central Park block a diamond in the rough

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for 4 weeks then price increases to the regular rate of $19.00 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.75/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 03/09/2019 (2291 days ago), so information in it may no longer be current.

Does a $22,900 condo unit recently listed in Winnipeg’s downtown core sound like a steal of a deal to you?

If it does, you’re right — that price tag is just nine per cent of the $257,101 average price for a condo unit in Winnipeg’s metro region this July, according to the Winnipeg Realtors professional association.

But you’re too late to snap up that ultra-cheap condo unit, because Phillip Fehr beat you to it.

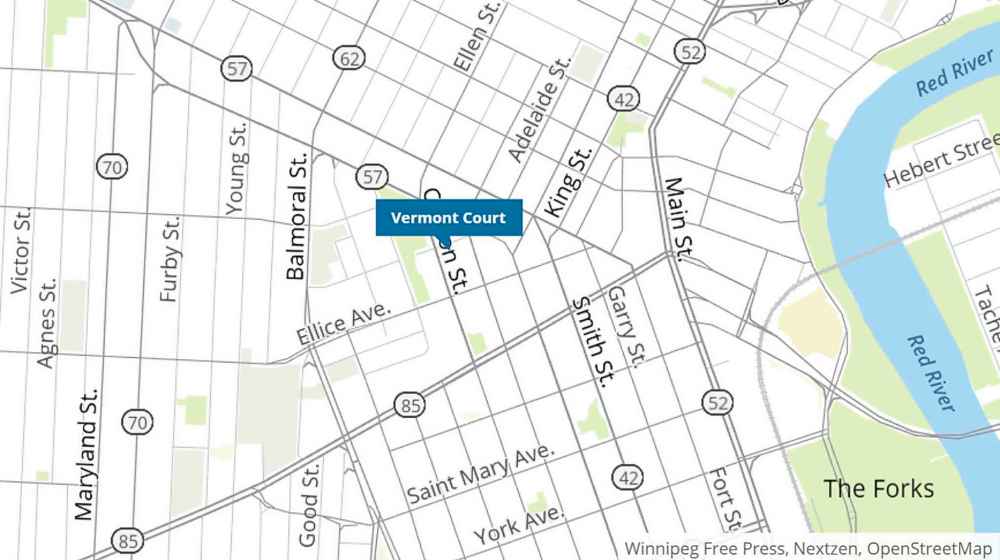

The local property owner and manager said he ended up offering $24,000 to buy the 437-square-foot bachelor unit, which was in foreclosure. The unit is one of 16 at 350 Qu’Appelle Ave., in the Vermont Court building that’s kitty-corner to Central Park. The western half of the structure, which has a separate address at 377 Carlton St., remains boarded up after a fire in 2011.

Fehr couldn’t show off his discount property when the Free Press visited last week, since he hadn’t taken possession yet. But he’s no stranger to the three-storey brick building, where he already owns three other units. Fehr’s history with Vermont Court goes back to 2007, when he bought his first property in the building for just $21,000 at the age of 23.

“My thought then was, you can never lose money on that,” he said.

In Fehr’s early days with Vermont Court, he and a business partner bought a number of units — at one point Fehr said he owned seven suites. (The cheapest was bought in a private sale in 2008 for just $17,500.) Fehr and his partner got busy renovating and reselling those units, which he said fetched between $95,000 and $120,000 from 2010 to 2012. Fehr lived in the building himself for a time, and served as property manager.

“And then a lot of new owners started coming in and they wanted a new management company, so we moved it to Imperial Properties,” Fehr recalled.

“And they did that for about eight years… It wasn’t managed efficiently, there were bad decisions made, and the value of the properties just kept going through the floor. Finances weren’t managed well.”

Imperial Properties president Adrian Schulz confirmed the condo corporation had hired Imperial as a third-party manager. The management agreement was terminated at Imperial Properties’ request, he said.

“We work for the board, and we do as the board says,” said Schulz, who added that it’s unusual for his company to terminate a management contract.

“When we can’t carry out our duties due to a lack of funding in that condominium corporation, our hands are tied.”

Current condo board president Phillip Fehr said monthly condo fees at Vermont Court shot up from about $175 to as high as $350 as the building declined over the years. (The listing for his newly purchased unit puts the fees at $306.85.)

“People can’t afford it, and because they can’t afford it now they’ve had to sell them for super-cheap,” said Fehr. “And people can’t afford to buy it because of the condo fees, so that’s why the prices are so low.”

Fehr said the building’s unit owners collectively manage maintenance, with Fehr serving as president of the condo board. Brydges Property Management handles financial management. Ultimately, Fehr said he’d like to acquire more units in the building, build up a reserve fund with maintenance fees, then invest that money in overhauling the 1909 structure’s plumbing and electrical systems and converting bachelor units to one-bedroom suites.

“I think it’s going to be a very valuable building. It’s going to take about three to five years, but my plan is, I think entry-level suites will be worth $100,000 in three years in this building, the way I’m going do it.”

Fehr’s confidence in the future value of Vermont Court is based on research he did before purchasing his first unit in 2007.

“I noticed a lot of government investment downtown, and then I started seeing the big private-sector guys developing downtown, so I became convinced that this was a revitalization effort that was actually, possibly, going to take downtown.”

Winnipeg’s 2010 project to revitalize Central Park helped improve the neighbourhood, Fehr believes. He also sees promise in efforts to remove surface parking lots downtown, densify the area, and make downtown friendlier to Winnipeggers who want a car-free lifestyle.

“I see that happening a lot with the bike lanes, they’re trying to make biking and public transit more friendly,” said Fehr. “When I see that happening, I know that’s one of the incentives of trying to revitalize downtown, so I support that.”

If Fehr can successfully make capital improvements to Vermont Court and reduce condo fees, he expects the building’s units will attract new buyers, both investors and tenants.

“The strategy is very simple, but it’s not easy… I could tell anybody exactly how to do it, but having the dedication and the commitment — you’ve got to be a bulldog and keep pushing and pushing, because problems always keep up.”

solomon.israel@freepress.mb.ca

@sol_israel

1.jpg?h=215)