MPI claims plunge as pandemic decreases traffic

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for 4 weeks then price increases to the regular rate of $19.00 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.75/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 07/04/2020 (2076 days ago), so information in it may no longer be current.

Manitoba Public Insurance is processing fewer claims as the pandemic prompts people to leave their vehicles in park more often, but there’s few guarantees customers will see financial savings in the short term.

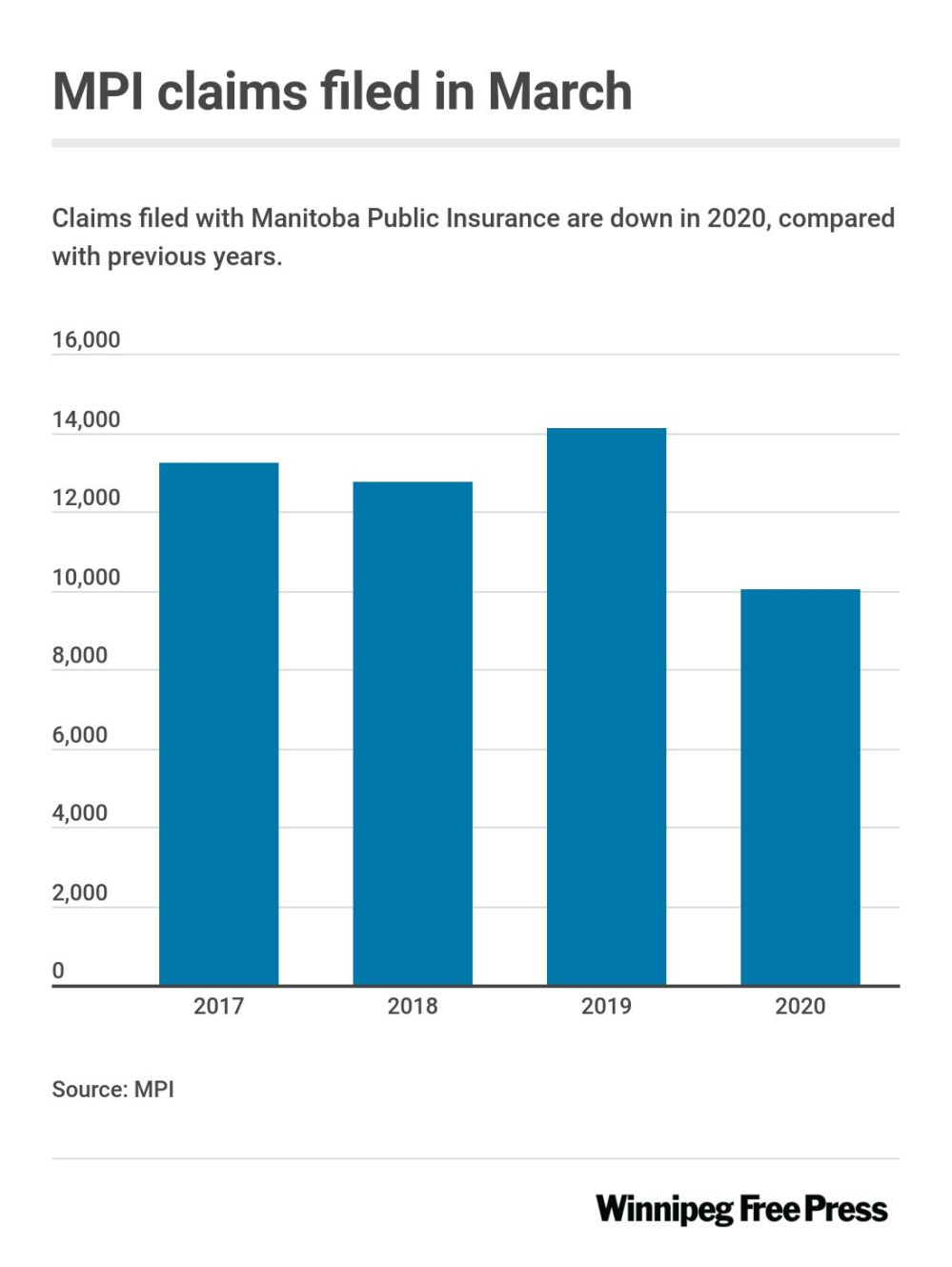

The Crown corporation received 4,108 fewer claims in March compared to the same period last year, according to data provided by MPI. A total of 10,016 claims were opened last month, media relations co-ordinator Brian Smiley said, representing a significant drop in collisions compared to years prior, as traffic volumes province-wide have diminished.

“What reduced collisions translates into typically is lower payouts,” Smiley said. “Meaning, we’re not writing off that $35,000 truck perhaps, because of reduced collisions.

“Reduced collisions also translates into fewer serious injuries, fewer fatalities and those are all positives in what we would describe as a very tumultuous time for all of us.”

In the U.S., auto insurers Allstate and American Family Insurance are returning millions of dollars to customers as traffic volumes drop. On Monday, Allstate said it would return $600 million in premiums to U.S. customers, and most policy holders will get back 15 per cent of their premium in April and May. The Canadian branch of Allstate told CBC on Monday it was developing a similar policy for its customers.

It’s too early to know how the pandemic will impact MPI’s finances, Smiley said, or if Manitobans will see a rebate on their premiums. The corporation is facing revenue losses related to the pandemic response and additional expenses incurred when it set up work-from-home arrangements for staff, Smiley said.

On Friday, Premier Brian Pallister announced financial relief for citizens by way of MPI and directed the corporation to stop charging interest or penalties if customers cannot pay their principal. The corporation has also been told to relax its practices on renewals and collections.

In B.C., where auto insurance is administered provincially, the Insurance Corporation of British Columbia has allowed its customers to apply for penalty-free payment deferrals for up to 90 days.

Without going into specifics, Smiley said MPI has considered additional options for policy holders.

“We’re absolutely aware that people are financially in tough situations right now. We’ve discussed a number of options, and we can’t share them at this point because they haven’t been approved.” – MPI media relations co-ordinator Brian Smiley

“We’re absolutely aware that people are financially in tough situations right now. We’ve discussed a number of options, and we can’t share them at this point because they haven’t been approved,” he said.

“Having said that, we obviously take our direction from government, and so at this particular point in time, what we have implemented is the waiving of the fees, but we’re certainly looking at a number of options in order to help assist our customers and ease their financial burdens.”

Opposition NDP leader Wab Kinew said Manitobans would welcome a rebate on MPI premiums, if the corporation has the financial footing to do so.

“They’re probably able to strike a reasonable balance between looking after the long-term financial interests of the corporation while still being able to say, maybe we can return a chunk of this money now to Manitoba families who need it today,” Kinew said.

“The role of government should be to step in, get the best advice from MPI, and direct them to help Manitoba families who are feeling a cash crunch right now.”

For a fee, people can change their coverage if their vehicles are parked at home by calling their Autopac agent or MPI. Pleasure vehicle coverage is a bit thriftier than all purpose, and lay up coverage (for vehicles that are put into storage) can mean a difference of up to $1,100 annually, Smiley said. So far, most customers are sticking with their basic coverage policies.

The corporation will go forward with its general rate application to the Public Utilities Board in May, barring unforeseen circumstances, Smiley said. The rate has yet to be determined but is based on pre-pandemic financial forecasts and figures.

Byron Williams, a lawyer with the Consumers’ Association of Canada-Manitoba, said there are two ways fewer collision claims this year could result in lower premiums in the future: if the corporation’s reserves are excessive MPI may be able to lower rates; or, if collision claims remain low in 2020-21 and are projected to stay low into 2021-22.

Over the past two decades, there have been rebates totalling close to $600 million, he noted.

“A key thing to remember is that a lot of MPI costs arise in winter, so even if we have a slow few months, a bad winter can change the results quickly,” Williams said.

danielle.dasilva@freepress.mb.ca

Our newsroom depends on a growing audience of readers to power our journalism. If you are not a paid reader, please consider becoming a subscriber.

Our newsroom depends on its audience of readers to power our journalism. Thank you for your support.