Province’s finances headed in the right direction for the first time in a long time

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for 4 weeks then price increases to the regular rate of $19.00 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.75/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 04/03/2020 (2106 days ago), so information in it may no longer be current.

It was a small victory for the bean counters at Manitoba Finance, but it was an important milestone.

The provincial government released its third-quarter financial update this week, and for the first time in years, the province’s debt as a percentage of the economy shrunk.

Manitoba is expecting a smaller deficit of $325 million for the fiscal year that ends March 31, down slightly from a budgeted shortfall of $360 million.

It’s a larger deficit than the one recorded in 2018-19, which came in at $163 million, but that year’s shortfall was lower than expected due to a number of one-time, non-recurring events that included Manitoba Public Insurance cashing in $100 million worth of assets.

When Finance Minister Scott Fielding unveils his budget next Wednesday, the projected deficit will likely be lower than $325 million. The Pallister government has pledged to balance the books by 2022 — an achievable goal, barring a severe recession or some other unforeseen event, such as a major flood.

Lower deficits have helped reduce the growth of the province’s debt, so has a reduction in capital spending, after the province substantially underspent its infrastructure budget in 2019-20.

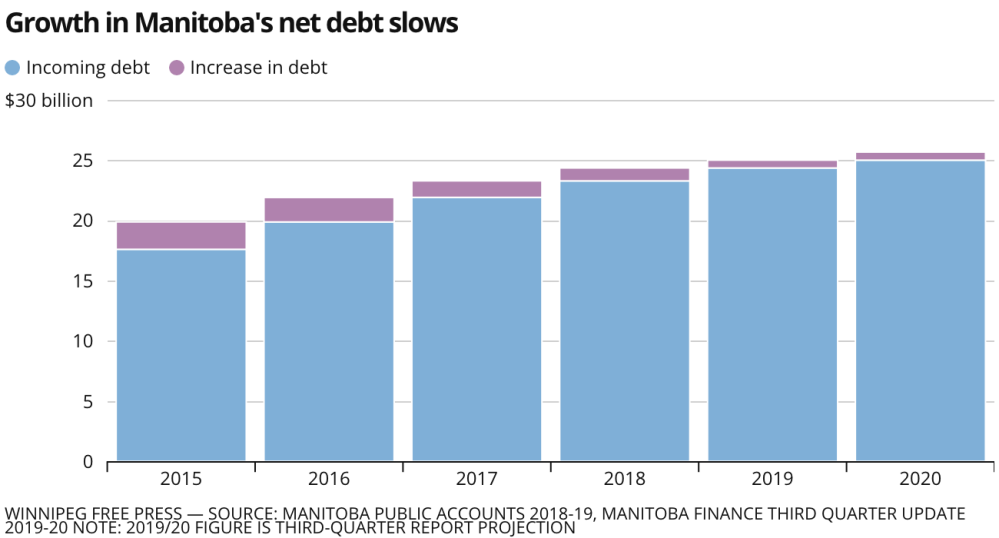

According to this week’s fiscal update, the net debt is projected to be $25.667 billion in 2019-20. That’s up $668 million from the previous year. But the growth rate of the provincial debt has fallen substantially in recent years. Under the previous NDP government, debt rose $2 billion a year towards the end of its mandate.

As a percentage of the economy, or GDP, debt grew from 21.2 per cent in 2007 to a high of 34.6 per cent last year. Now, for the first time in more than a decade, that number has changed direction. This week’s report pegs the debt-to-GDP ratio at 34.3 per cent. It’s not a substantial decrease, but it’s an important turning point for a government that’s trying to put the province’s finances on more solid footing.

Debt-to-GDP is something international bond rating agencies place a great deal of emphasis on when setting governments’ credit ratings. When debt was rising by $2 billion a year, the Manitoba government saw its credit rating downgraded three times in as many years. That drove up the cost of borrowing for the province, which has now reached $1 billion annually.

In last year’s budget, government projected debt-to-GDP would decline slightly each year to 32.7 per cent by 2024. That will likely be revised in next week’s budget and could fall further, but this week’s update was the first concrete sign that it’s starting to fall.

Meanwhile, net debt as percentage of total revenue — another measurement credit rating agencies focus on — has also been on the decline recently. After successive years of increases, it fell to 147.3 per cent in 2019, down from 150.7 per cent the year before. It’s another sign government is beginning to get its debt under control.

It will be some time — likely many years — before the province can stop the rise of debt altogether. In the short term, the goal is to ensure debt grows slower than nominal GDP (not adjusted for inflation). When it does, the debt-to-GDP ratio falls.

Even after the deficit is eliminated, the province is still expected to borrow to pay for core operations. That’s because while the books may be balanced in the summary budget (which includes outside agencies such as Crown corporations, post-secondary institutions and school divisions), spending on core government operations may still exceed revenues.

The province still has a long way to go before it gets its finances under control. With economic uncertainty ahead, including the possibility of a global economic downturn, the challenge of balancing the books and slowing the growth of debt could prove more difficult.

However, with a substantially lower deficit — it was $932 million when Pallister took office — the province is in a far better position to fight a recession, should it occur. It’s one of the many reasons governments should maintain a healthy set of books.

tom.brodbeck@freepress.mb.ca

Tom has been covering Manitoba politics since the early 1990s and joined the Winnipeg Free Press news team in 2019.

Our newsroom depends on a growing audience of readers to power our journalism. If you are not a paid reader, please consider becoming a subscriber.

Our newsroom depends on its audience of readers to power our journalism. Thank you for your support.