Carbon tax to raise energy prices, but families will come out ahead Gas price at pump to rise 4.42 cents per litre in April, increase annually

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$1 per week for 24 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $4 plus GST every four weeks. Offer only available to new and qualified returning subscribers. Cancel any time.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 23/10/2018 (2323 days ago), so information in it may no longer be current.

Three weeks after Premier Brian Pallister’s abrupt abandonment of a Manitoba-made carbon tax plan, Ottawa fired back with its plan on how the province will start paying the new environmental levy.

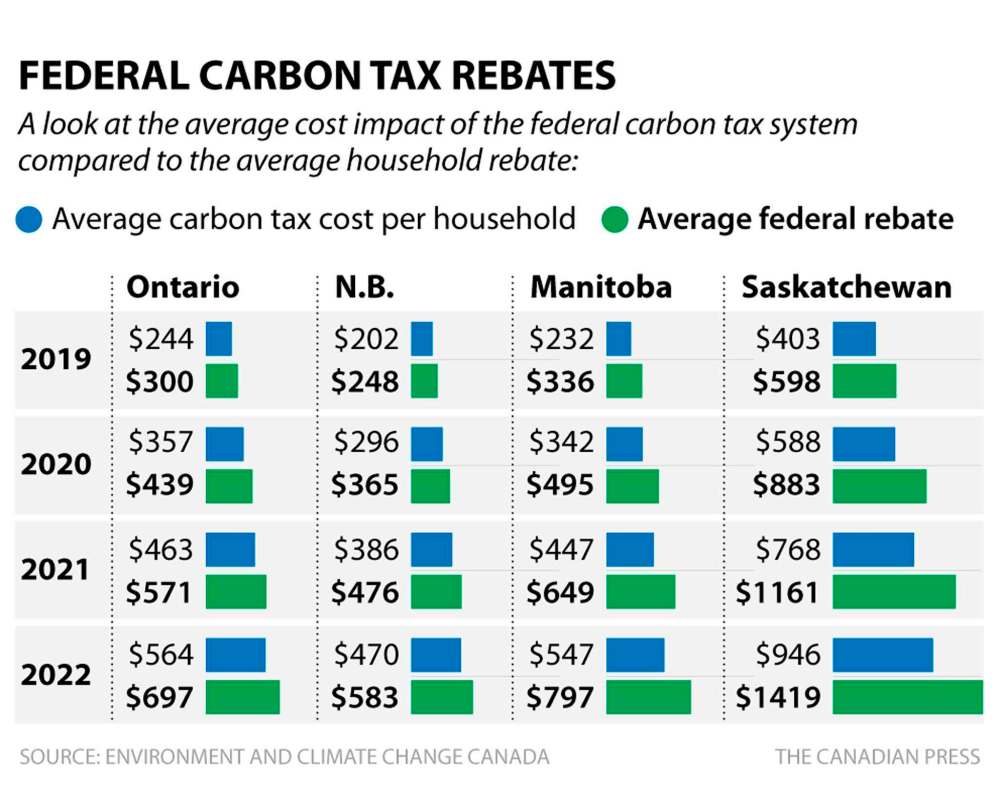

Ottawa says the average Manitoba household will pay less in carbon taxes next year than it receives in federal rebates — and the money will be paid out just months before next fall’s national election. Manitoba, Saskatchewan, Ontario and New Brunswick were the target of Tuesday’s announcement — provinces the feds had determined as not having adequate carbon tax plans.

The federal government announced the cost of gasoline will rise by nearly five cents a litre in April. Heating fuels will also rise at that time.

Because Manitoba’s Progressive Conservative government abandoned its proposed carbon tax plan Oct. 3, Ottawa will institute its own plan for the province.

Unlike provinces that have adopted the federal carbon pricing plan, the Manitoba government will not control how the tax revenues are used. Instead, beginning next year, rebates will be paid to individuals when they file their income tax.

Under the federal program, the average Manitoba household will pay $232 in carbon taxes next year, but receive $336 in rebates. By 2022, under the escalating tax, the average household will pay $547 in carbon taxes, but receive $797 after filing their tax return, Ottawa estimates.

That means households will receive roughly nine months of revenues from the carbon tax in mid-2019, despite only having paid the levy for a few of those months. The rebates will arrive before the October 2019 federal election.

Trade Diversification Minister Jim Carr told a news conference in Winnipeg that Ottawa “will not keep one cent” of the money it collects.

“Every dollar collected is going right back to Canadians,” the MP for Winnipeg South Centre said. “Pollution shouldn’t be free in this country. Nobody should be allowed to pump unlimited emissions into the air we all share without consequence.

“To our opponents I say this: if you do not have plan for climate change then you do not have a plan for the economy and you do not have a plan for the future. While Conservative (provincial) governments are wasting time in court, we will be reducing pollution across the country now and sending the money we collect directly to you.”

Ontario and Saskatchewan have announced their intention to fight the carbon tax in court.

Premier Brian Pallister said he hasn’t ruled out a legal fight on the federally imposed carbon tax, and believes Manitoba stands a better chance of winning in court than other provinces.

“(The federal carbon tax plan) seems to me a pretty stark example of a lack of understanding of the diversity of the country, that the federal government would propose to bomb Manitoba with the same carbon tax, when we’re green, that they would impose on Saskatchewan, which is based on a bed of oil and produces more carbon outputs than we do by quite a bit,” he said Tuesday.

Pallister said the federal government hasn’t assured Manitoba it will receive all the intended share of its carbon tax revenue, beyond rebate cheques coming to taxpayers’ pockets. Ottawa promised $60 million for “undefined programs” to green the province, Pallister said, but he’s unclear when or how that money will flow.

“As far as we’re concerned, we haven’t seen any plan from the federal government on which programs (it will pursue),” the premier said.

In its announcement Tuesday, Ottawa said Manitobans living outside of the Winnipeg area will receive a 10 per cent higher rebate than urban residents, to compensate for higher energy use.

As part of the carbon levy, Ottawa will implement a fuel charge starting in April that will add 4.42 cents per litre to gasoline. Natural gas for home heating will rise by 3.91 cents per cubic metre. Both rates will increase annually until 2022.

The carbon tax is expected to generate $190 million in revenue from Manitoba in its first year, and $460 million by the fourth year. Ottawa says it will remit roughly seven per cent of the revenues to small businesses, and about three per cent to hospitals and schools.

Loren Remillard, president of the Winnipeg Chamber of Commerce, decried the federal announcement as a “one-size-fits-all” solution that will penalize Manitoba business.

He said the reason individual Manitobans will recoup more in rebates than they pay in carbon taxes is business will be subsidizing them.

“Our biggest concern with carbon pricing was how it would position Manitoba companies vis-a-vis our main competitors, and (Tuesday’s) announcement is not good news for business,” Remillard said, adding “trade-exposed” industries will be particularly affected.

“There’s really nothing of any significance that will be coming back to business to… help them deal with reducing greenhouse gas emissions and… mitigate the impact to business in terms of its competitive position with the U.S.”

The carbon tax won’t apply to some forms of heavy industry, such as fertilizer and steel plants. Instead, these businesses will have the option of a cap-and-trade or carbon-credit system, which has low-efficiency plants paying for carbon quota from greener firms. Otherwise, they’ll be rolled into a carbon tax, and Ottawa will use that revenue to reduce greenhouse gas emissions.

Federal officials are still ironing out those plans.

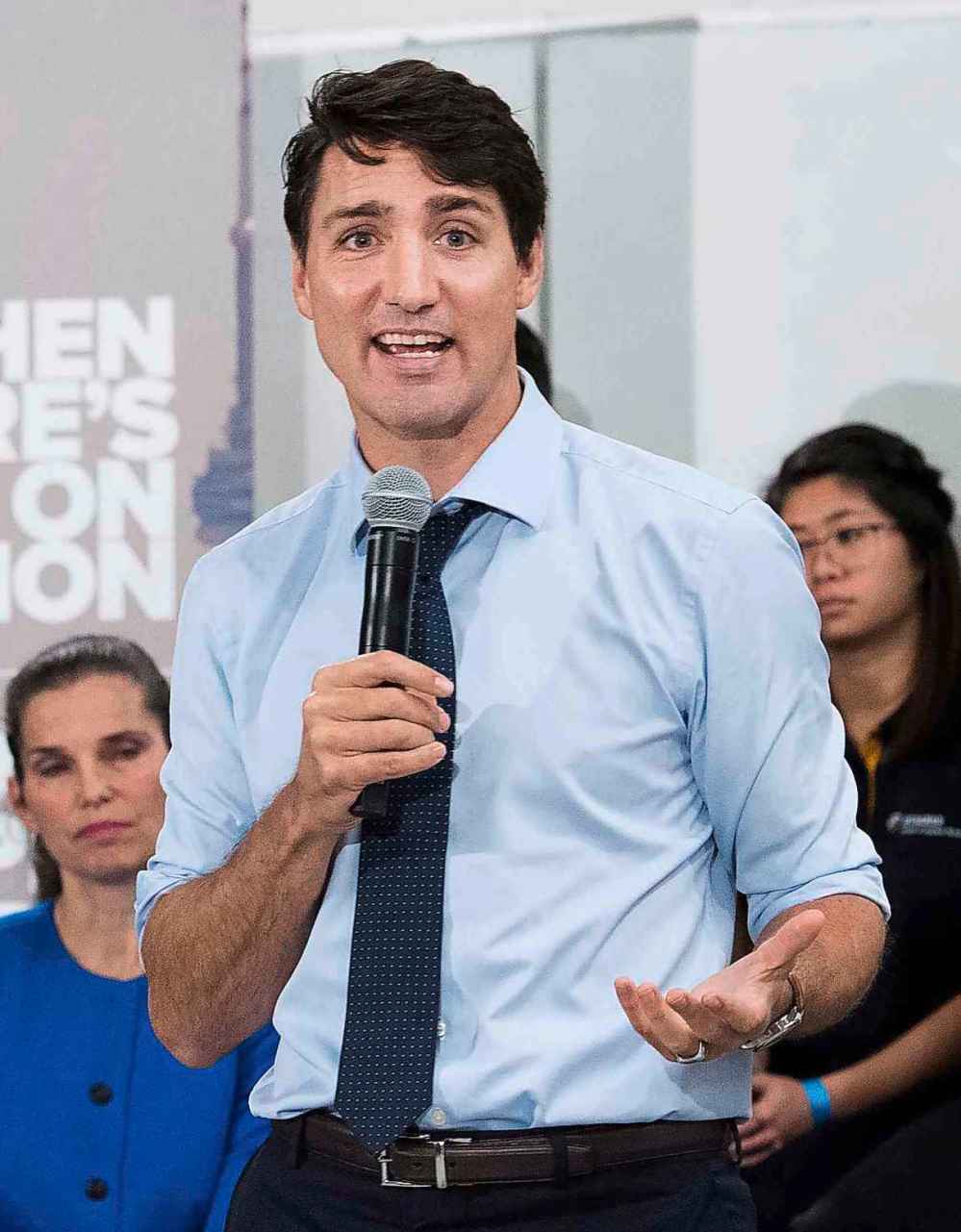

Speaking with reporters in Toronto, Prime Minister Justin Trudeau branded those who opposed his plan as political or economic opportunists.

“Their long list of excuses won’t cut it anymore,” he said.

The prime minister said provinces that reject a carbon tax “will have to answer difficult questions” from citizens about how to address the climate crisis. He did not cite Manitoba.

Trudeau rejected claims he was buying votes by giving Canadians their carbon-tax rebates ahead of next fall’s election — before those revenues had been collected.

“We will be giving upfront the money to people” so “people get support as we move forward into this transition,” he said.

That didn’t convince federal federal Conservative Leader Andrew Scheer, however.

“Canadians won’t be tricked by this; they know an election gimmick when they see one,” he said.

dylan.robertson@freepress.mb.ca

larry,kusch@freepress.mb.ca

jessica.botelho@freepress.mb.ca

Larry Kusch

Legislature reporter

Larry Kusch didn’t know what he wanted to do with his life until he attended a high school newspaper editor’s workshop in Regina in the summer of 1969 and listened to a university student speak glowingly about the journalism program at Carleton University in Ottawa.

Our newsroom depends on a growing audience of readers to power our journalism. If you are not a paid reader, please consider becoming a subscriber.

Our newsroom depends on its audience of readers to power our journalism. Thank you for your support.

History

Updated on Tuesday, October 23, 2018 1:53 PM CDT: Writethrough

Updated on Tuesday, October 23, 2018 6:23 PM CDT: Full write through, final version. Adds photos

Updated on Tuesday, October 23, 2018 6:27 PM CDT: Adds photo.