Pandemic changed the way we shop forever

Traditional supermarkets losing influence to indie grocers, discount stores, study suggests

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$1 per week for 24 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $4 plus GST every four weeks. Offer only available to new and qualified returning subscribers. Cancel any time.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 04/06/2021 (1369 days ago), so information in it may no longer be current.

Will Canadian grocery shopping ever be the same again?

That’s a question leading food economists and supply chain experts have been mulling progressively, as the COVID-19 pandemic created and accelerated dozens of new trends for the industry throughout the past year.

A new report from the Agri-Food Analytics Lab might provide a few answers.

Surveying more than 10,000 Canadians from coast to coast in May, a team of researchers out of Dalhousie University aimed to understand how the pandemic could impact the grocery experience in the near future.

The study reveals a range of changes across the board since the onset of the coronavirus — from the idea of permanent physical distancing, online groceries and local shopping to self-checkouts, and shifting loyalties with the type of retail outlets people prefer.

“What we found is a really wide variety of ways in which the human psyche for grocery shopping has changed quite drastically,” said Sylvain Charlebois, a food management professor who led the team of experts that conducted the study.

“Certainly, it doesn’t seem like these changes are going away any time soon,” Charlebois told the Free Press Thursday. “And what that means for the industry is that they’ll have to start evaluating exactly where they make key investments in the coming years which, of course, will also impact shoppers themselves.”

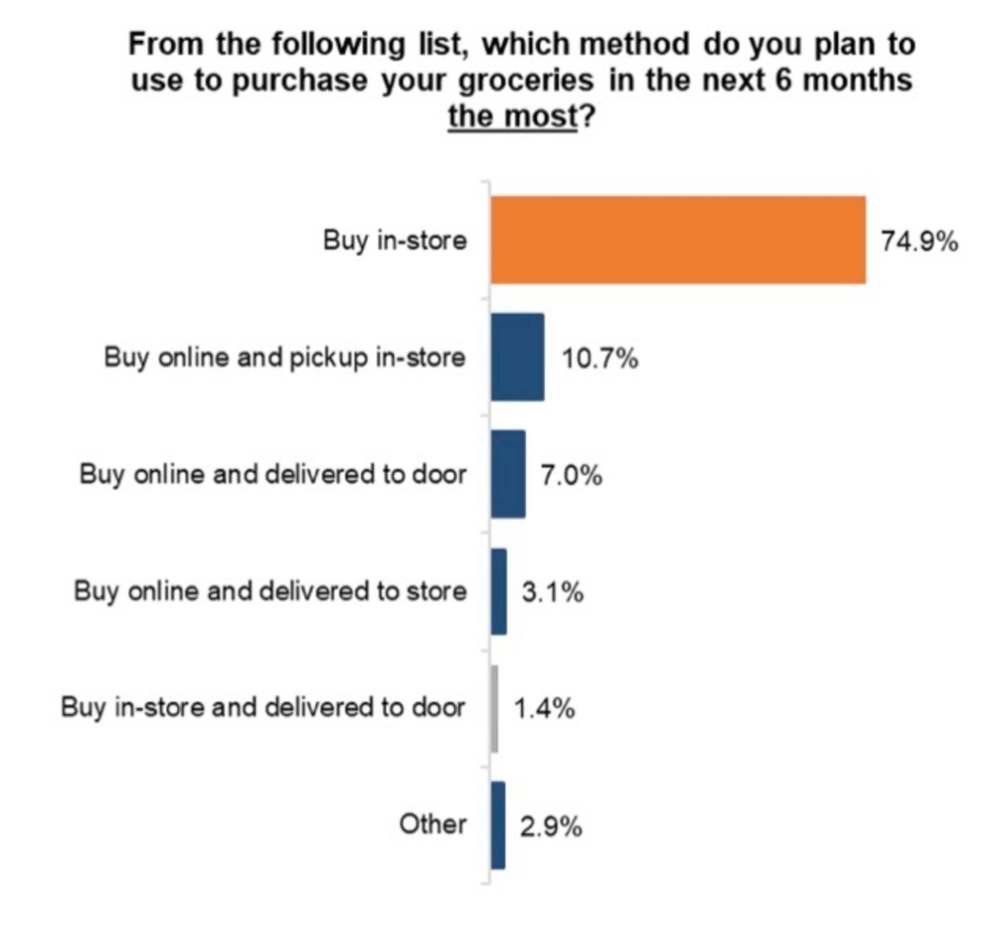

As the pandemic forced people to stay at home and work from there, a rat race of options emerged across the grocery sector — from larger chains to smaller retailers — so people could get their food safely. This quickly resulted in a radical bump for online and pickup sales throughout Canada, where previously in-person grocery shopping was king.

The Agri-Food report suggests that’s a trend which is here to stay. More than 22 per cent of all Canadians intend to buy online regularly and the percentage for pickup also remains “stubbornly high,” said Charlebois. It’s good news for companies like Amazon alone, which nearly 10 per cent respondents said they use as a regular food provider.

A quarter of Canadians have also changed where they shop for groceries altogether in the last year. That’s a “significantly high” number, likely due to how consumers perceived risks when visiting a store, said Charlebois. Physical space and coronavirus cases reported may have played a role “as a fear factor” in motivating consumers to look for a different store, he added.

Canada’s three big traditional stores (Loblaw, Sobeys, and Metro) are becoming less influential, the Agri-Food report suggests, despite their skyrocketing revenues during the pandemic.

That’s because of several different reasons — including increased popularity for independent outlets, Canadians’ reinvigorated love of discount stores, and new players in the field creating other options.

Over 24 per cent of Canadians are likely to visit a drug store for food and 16.5 per cent will visit a dollar store to buy their groceries. On top of that, almost two-third Canadians want to spend up to 19 per cent of their food budget at independently owned and operated stores. And a total of 70.2 per cent respondents said they’ll actively look for promotions and discounted food products.

“It’s a sign of the supply chain becoming more democratized and open,” said Charlebois. But despite this push to support independent grocers, a “local paradox” has been created during the pandemic, he said.

People want to see local products (75.2 per cent of all Canadians). However, that support significantly drops when asked whether they intend to buy (only 47.4 per cent over the next six months).

“I don’t really agree with many of these findings necessarily,” said Munther Zeid, owner and operator of Winnipeg-based Food Fare stores, in an interview Thursday.

“Although pickup and deliveries are obviously up, I would say that people will return and are already coming back for in-store shopping by and large. That won’t change.”

Zeid said he also doesn’t expect people would go to a local store like his and purchase many non-local products. “That’s just not the type of experience you expect when you go to a place like ours,” he added.

According to the study, self-checkouts will remain popular. Almost 40 per cent of people intend to use them most of the time in the next six months. Loyalty programs are also critical, which will influence 73.1 per cent Canadians when purchasing food products.

But perhaps most crucial are store designs for continued physical distancing. A total of 54.7 per cent Canadians think grocers would offer a better experience should those design changes continue.

Zeid agrees, adding he will keep using the precautionary measures put in place during the pandemic as a mainstay at his store.

“At the end of the day, it’s all up to the customers,” he said. “So, whichever way they show their inclinations, that’s where us and other grocers will go after COVID.”

temur.durrani@freepress.mb.ca

Twitter: @temurdur