‘People are making really difficult choices’: Manitobans feeling squeeze of inflation

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$19 $0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for four weeks then billed as $19 plus GST every four weeks. Offer only available to new and qualified returning subscribers. Cancel any time.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 15/12/2022 (741 days ago), so information in it may no longer be current.

Debbie Waller knows what it is like to tighten her financial belt, amid the rising cost of living and fear of a recession.

Separated and on sick leave from her job as a health-care aide, Waller has cut back on everything she can and now, for the first time in her life, has had to rely on Harvest Manitoba food bank.

“It all disappeared overnight for me,” Waller said Friday. “It has been challenging. It would be pretty tough without Harvest.”

She is far from alone.

A Free Press-Probe Research poll has found most Manitobans are looking at a lump of financial coal as they head into a holiday season.

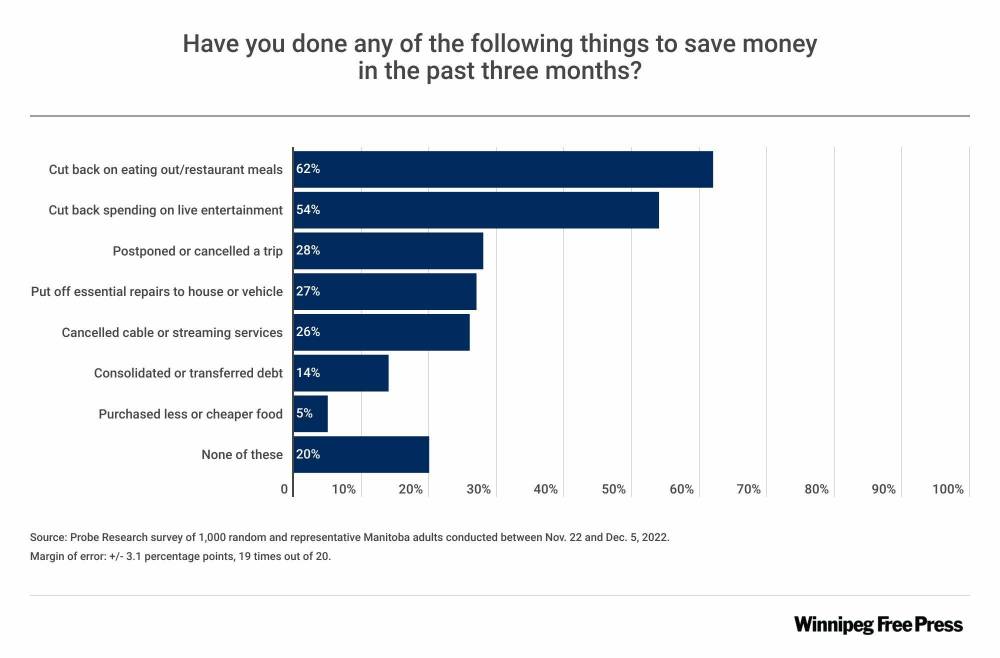

More than six in 10 already say they’re eating at restaurants less often, 54 per cent have cut back on entertainment (including movies and concerts), and more than one-quarter have cancelled or postponed trips, put off needed household or vehicle repairs, and cut the cord on streaming services or cable TV.

The poll also found one in five Manitobans haven’t adjusted their spending at all.

Vince Barletta, chief executive officer of Manitoba Harvest, said the food bank has already seen a 40 per cent jump in the number of people who need its services. With continued rising prices and economic uncertainty, he expects to see the number rise.

“People are making really difficult choices,” Barletta said. “The big change is 93 per cent of the people we see say they are changing the way they shop for groceries. They can’t afford as much fresh fruit and vegetables and not so much meat or protein.

“Instead of chicken, it might be chicken wieners.”

Many are expressing anxiety about the future, Barletta said.

“It used to be people talked about if they had a savings account for an emergency car repair or home repair. Now, unfortunately, they don’t have any savings. It’s how much room is left on their credit card for emergencies.”

Michelle, who didn’t want her last name used, said a long-planned trip to Disney World with her family next month has now been cancelled.

“The prices have risen,” she said. “It sounds silly — such a first world problem — but we haven’t had a vacation for five or six years. And, with a variable mortgage, we are now paying $400 more each month.

RUTH BONNEVILLE / FREE PRESS FILES

Vince Barletta, chief executive officer of Manitoba Harvest, said the food bank has already seen a 40 per cent jump in the number of people who need its services.

“This is a dream we likely have to give up.”

Susan Postma, CAA Manitoba regional manager, said the travel agency side of its business is booming, but there is a caveat.

“We don’t know how many have chosen not to see us,” Postma said. “But we are busy, we are at pre-pandemic levels. There is pent-up demand.”

However, there are clients who have changed travel plans, she said.

“Sometimes, people who did a Mexican vacation for 14 days each year are now going for 10. And, instead of Disney World (in Florida) with a family, we see more now travelling domestically.”

Prairie Theatre Exchange managing director Lisa Li said the economy, along with post-pandemic trepidation, is hitting local theatre groups at the box office.

“Tickets are down by about a third, with our subscribers not returning,” Li said.

“Grocery bills are going up, utility bills are going up and it is eating into their entertainment budget. And some of it is if you’re a senior in a vulnerable demographic who is afraid to be with crowds (due to COVID-19 fears), you’re not coming either.”

Li believes some will never return to live theatre.

Silver Heights Restaurant is booked for Christmas parties this year, according to owner Tony Siwicki. But in what is traditionally the busiest season for restaurants, the empty tables are noticeable.

JESSE BOILY / FREE PRESS FILES

Noting restaurants rely on holiday season traffic to get them through the annual drop off of business early in a new year, Tony Siwicki said: “I think we have something to be worried about in January and February. I just have that feeling. I think it will be tough.”

“It has been more and more and more,” he said. “If you leave out the Christmas parties, there are a lot of tables which would normally be full.

“It’s the entertainment dollars. If you go into the grocery store and everything is up, your budget for entertainment goes down.”

Noting restaurants rely on holiday season traffic to get them through the annual drop off of business early in a new year, Siwicki said: “I think we have something to be worried about in January and February. I just have that feeling. I think it will be tough.”

Waller said not too long ago she would have seen grocery prices rising but still filled her cart. Now, between rent, groceries and a limited income, she has gone to Harvest for support for the last three months.

“What I get now (on sick leave) is 55 per cent of what I was getting before, if that,” she said. “I buy things like frozen meals — healthy ones — that are on sale.

“Inflation is ridiculous. People need shelter and food to live. These are basic necessities, but I live paycheque-to-paycheque. It can be quite nerve wracking when you don’t know about the future.”

kevin.rollason@freepress.mb.ca

Kevin Rollason

Reporter

Kevin Rollason is one of the more versatile reporters at the Winnipeg Free Press. Whether it is covering city hall, the law courts, or general reporting, Rollason can be counted on to not only answer the 5 Ws — Who, What, When, Where and Why — but to do it in an interesting and accessible way for readers.

Our newsroom depends on a growing audience of readers to power our journalism. If you are not a paid reader, please consider becoming a subscriber.

Our newsroom depends on its audience of readers to power our journalism. Thank you for your support.