Province offers COVID relief with $200M in budget tax cuts Property owners, farmers to benefit from 25 per cent rebate on education levies

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$19 $0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for four weeks then billed as $19 plus GST every four weeks. Offer only available to new and qualified returning subscribers. Cancel any time.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 06/04/2021 (1361 days ago), so information in it may no longer be current.

Anticipating a $1.6-billion deficit this year amid a global pandemic, the Progressive Conservatives are cutting taxes by $200 million, most of which is in the form of a hefty rebate to homeowners and farmers on their education levies.

Owners of residential and farm properties will receive a 25 per cent rebate of the school division special levy and the community revitalization levy payable.

A homeowner with a $1,700 school division special levy will receive a rebate cheque of $425 this year.

Property owners will receive their rebate cheques at about the same time their municipal taxes are due. They won’t have to apply for the rebate, which will be automatically sent by the province.

The cut will cost the province $190 million this year. The government said it intends to increase the tax rebate to 50 per cent of education property taxes on residential and farm property in 2022.

The government is also exempting the retail sales tax from personal services, such as haircuts, non-medical skin care and spa services, effective Dec. 1.

“We think it’s important to provide direct tax support and relief for Manitobans, particularly during this tough and challenging time economically,” Finance Minister Scott Fielding said.

Since residential landlords — not renters — will benefit from the 25 per cent rebate, Manitoba will set annual rent-increase guidelines of zero per cent for 2022 and 2023. Landlords will still be able to apply for above-guideline rent increases if they make material improvements to a property.

Owners of other properties, such as commercial, industrial, institutional and designated recreational, will receive a 10 per cent rebate of the total of both the school division special levy and the educational support levy payable.

The timetable for eliminating education taxes from property is proceeding far more rapidly than the Progressive Conservatives promised during the 2019 election campaign. At that time, the party promised to begin the phaseout in the last two years of their mandate and to complete it over 10 years.

Asked whether it was risky for the government to rebate such a large portion of the education property tax at a time of high deficits and economic uncertainty, Premier Brian Pallister shot back: “I think it would be risky not to.”

He said the government is moving to “a fairer and more reasonable way” of funding education “without punishing senior citizens for trying to stay in their own home a little longer, or picking on farmers.”

“We think it’s important to provide direct tax support and relief for Manitobans, particularly during this tough and challenging time economically.” – Finance Minister Scott Fielding

Also among this year’s budget highlights is the establishment of a $25-million trust fund to redevelop the downtown Hudson’s Bay building, a $22-million addition to the Rent Assist program, which helps low-income residents with accommodation costs, and a 10 per cent reduction in vehicle-registration fees.

The government is also introducing a new Teaching Expense Tax Credit, which will allow school teachers to claim a 15 per cent refund for up to $1,000 on the cost of eligible supplies that come out of their own pocket.

Meanwhile, the government will start charging the retail sales tax on streaming services such as Netflix, online marketplaces and online accommodation platforms on Dec. 1. Over the course of a full year, it expects to reap a total of $26.5 million from the measures.

Pallister said taxing digital services is about making the tax system fairer to everyone.

“The present structure was a free ride for some and an additional unfair disadvantages to others,” he told reporters, noting other jurisdictions are also taxing such services.

Fielding announced last week that Manitoba is projected to incur a $1.597 billion deficit for the 2021-2022 fiscal year. That compares to a forecast deficit of $2.08 billion for 2020-2021.

If not for the pandemic, which added costs and curbed tax revenues, the government said it would have achieved a surplus last year.

The province pegs the cost of COVID-19 expenditures and contingencies at $1.18 billion for the coming year compared with $1.98 billion for the fiscal year just ended.

NDP Leader Wab Kinew said it’s clear the PC government has not learned any lessons from the pandemic.

While he is “open-minded” on the question of how education should be funded, the cash for the proposed rebates has to come from somewhere, he said.

“It’s coming from underfunding seniors care, it’s coming from cuts in real dollars to the health-care system, and it comes from underfunding the education system,” Kinew said. “That’s not the right approach, least of all while the pandemic is still ongoing.”

Liberal Leader Dougald Lamont said the education system is in particular need of emergency funding, and he did not see any commitment in the budget to rectify the situation.

“There are school divisions that are going to face massive shortfalls because they have spent money keeping children safe, and they are not going to be able to balance their budget without help from the provincial government,” he said.

“There are school divisions that are going to face massive shortfalls because they have spent money keeping children safe, and they are not going to be able to balance their budget without help from the provincial government.” – Liberal Leader Dougald Lamont

Lamont called the government’s education tax rebate plans “incredibly regressive” and “colossally unfair.” He decried the fact that they would also apply to out-of-province owners of railways and pipelines.

The Canadian Taxpayers Federation applauded the government for its property tax relief but said it needed “a stronger plan” to balance the books.

“It’s… good to see the government’s commitment to balance the budget, but it needs to work harder to hit that target sooner,” said Todd MacKay, the CTF’s Prairie director.

The government has set a target of eliminating the deficit within eight years.

Fielding said the province has committed $100 million in the budget to the vaccine rollout, which he considers “more than enough money” to immunize Manitobans against COVID-19. More than a third of the $100 million will go towards labour costs, he said.

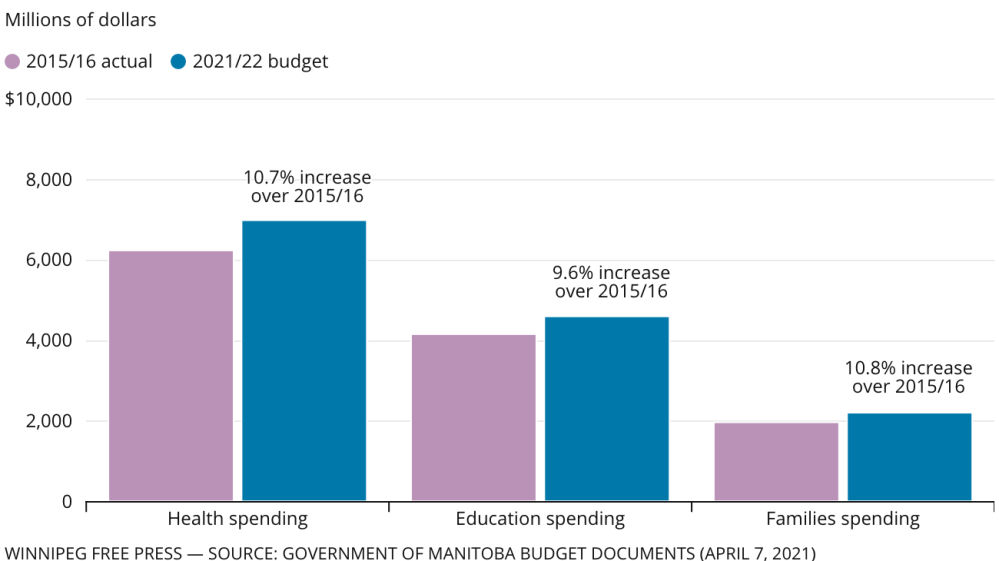

Pandemic-related expenses aside, the government projects Health Department spending to reach $6.62 billion this year, compared with a budgeted $6.48 billion last year.

Education Department spending is projected to be $3.07 billion for the coming year, up from $3 billion.

Three government departments — Finance, Agriculture and Resource Development and Sport, Culture and Heritage — are seeing drops in their budgets this year.

Manitoba is anticipating federal transfer revenues this year to rise to $5.64 billion, compared with $5.14 billion budgeted last year. The latest forecast has the province actually receiving $5.87 billion from the feds for fiscal 2020-2021. Federal transfers are forecast to make up 31 per cent of all revenues.

larry.kusch@freepress.mb.ca

Larry Kusch

Legislature reporter

Larry Kusch didn’t know what he wanted to do with his life until he attended a high school newspaper editor’s workshop in Regina in the summer of 1969 and listened to a university student speak glowingly about the journalism program at Carleton University in Ottawa.

Our newsroom depends on a growing audience of readers to power our journalism. If you are not a paid reader, please consider becoming a subscriber.

Our newsroom depends on its audience of readers to power our journalism. Thank you for your support.