‘My entire life has been taken from me’ Former owner of city crane company tells court of financial ruin as ex-CFO gets 6 1/2 years for defrauding business

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for 4 weeks then price increases to the regular rate of $19.00 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.75/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 22/09/2020 (1903 days ago), so information in it may no longer be current.

When R. Litz and Sons owner Bill Litz hired Peter Ramdath as its controller and chief financial officer, the future of the century-old, family-run Winnipeg business was looking as bright as it ever had.

Ten years later, after siphoning more than $4 million from the crane company, Ramdath left Litz and Sons in financial ruin, its four-generation legacy obliterated forever.

Ramdath, 44, pleaded guilty to one count of fraud earlier this year. On Tuesday, he was sentenced to six and a half years in prison.

“Everything I worked for my entire life has been taken from me,” Litz, 72, said in a victim impact statement provided to court.

“I worked hard to provide a good life for my family,” Litz said. “I planned on leaving (the company) to my son. I had everything planned out and until I hired Peter Ramdath everything was moving along nicely. Then, in just under 10 years, my life was ripped out from under me.”

The five-year fraud pushed the company, founded in 1904, into bankruptcy and ultimate dissolution. Court heard family members from two generations were forced to sell their homes and spend their life savings in an attempt to recover.

The work Litz and Sons did in the city was a source of enduring pride and happiness for the family, Litz said.

“I could look anywhere in the city and say: ‘My family built that,’” he said. “Now all I see are reminders of what was taken from us.”

Litz lost not only his company, he and his wife lost their house, car, land, “and every dime in investments I had.”

Now living in a small house owned by his daughter-in law, Litz said he is unable to help his son Will and wife Christine as they navigate their own struggle to make ends meet.

“The stress of this crime has destroyed me physically and mentally,” he said.

At its peak, Litz and Sons employed 100 people, with work projects stretching from Alberta to Ontario, Will wrote in his own victim impact statement.

Now, he’s often embarrassed to tell people his last name, fearing they will immediately connect him to the fraud.

“The company was my identity,” said Will, 43. “I want my life back, and I know that’s impossible. The only way I could get it back would be to travel back in time and make sure my dad never hired Peter Ramdath.”

Will said Ramdath nearly destroyed his relationship with his parents, driving a wedge between father and son and suggesting to Bill that Will was financially irresponsible.

“Peter convinced my dad I was spending an insane amount of money (and) my dad ended up not allowing me access to (the company’s) financial records,” he said.

Christine Litz told court she used to dream of the day she could join her husband in a leadership role at Litz and Sons.

“I am nowhere near the person I once was,” she said. “When the company died, a piece of me went with it… I was not able to have children, but the company would be my baby.”

“I could look anywhere in the city and say: ‘My family built that.’” – Bill Litz

Court heard Ramdath blamed his actions on a crippling gambling addiction, but that he also used the stolen company funds to pay for a lavish lifestyle, travel, an extravagant wedding and real estate and poured money into personal businesses that ultimately failed.

Ramdath was hired as controller at R. Litz and Sons in 2008, and subsequently became the company’s CFO, despite having no professional qualifications.

“He was trusted implicitly by the Litz family” and oversaw all of the company’s financial matters, Crown attorney Terry McComb told provincial court Judge Victoria Cornick.

The company began experiencing cash-flow problems in 2017, McComb told court. A subsequent audit pointed to Ramdath and police were contacted.

A police investigation found that between April 2012 and April 2017, Ramdath, through fraudulent invoices and other means, misappropriated $4.2 million for his own use.

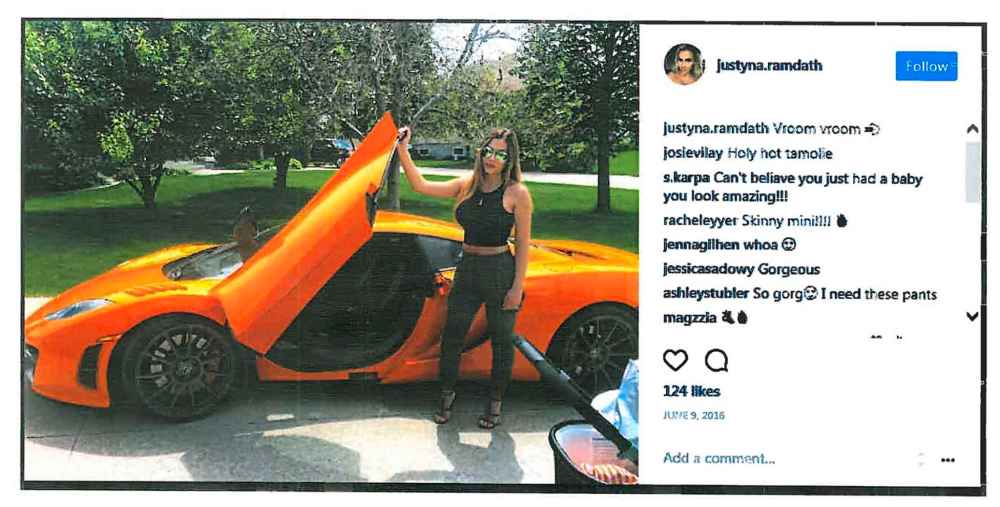

At the time of Ramdath’s January 2018 arrest, he owned an East St. Paul house, another on Manitoba Avenue, luxury vehicles including a 2008 Aston Martin, BMW and Maserati, jewelry, including a $43,000 ring, designer sunglasses, handbags and shoes, and cash in several bank accounts.

Ramdath’s wife Justyna was also charged with a fraud-related offence, but it was later stayed. Court heard the couple is no longer together.

A trial, had it gone forward, would have been long, elaborate and very complex, McComb said.

“In these circumstances, a guilty plea is a significant sign of remorse,” she said.

“The company was my identity. I want my life back, and I know that’s impossible.” – Will Litz

Since his arrest, Ramdath has taken steps to address his gambling addiction and rehabilitate himself, and has “found religion,” defence lawyer Richard Wolson said.

“He has turned his life around from the lifestyle he had,” Wolson said. “He is going to do everything he can to make his life better and his children’s lives better.”

Cornick called the scale of the fraud “pretty staggering.”

“This case is an example of how a non-violent offence can have similarly devastating effects on the victims,” she said.

In addition to prison time, Cornick ordered that Ramdath pay $4.2 million in restitution.

Last year, Litz and Sons sued auditing firms MNP LLP and Deloitte LLP for $50 million, alleging they were negligent in not detecting the fraud. The lawsuit against Deloitte was later dropped.

dean.pritchard@freepress.mb.ca

Someone once said a journalist is just a reporter in a good suit. Dean Pritchard doesn’t own a good suit. But he knows a good lawsuit.

Our newsroom depends on a growing audience of readers to power our journalism. If you are not a paid reader, please consider becoming a subscriber.

Our newsroom depends on its audience of readers to power our journalism. Thank you for your support.

History

Updated on Tuesday, September 22, 2020 12:14 PM CDT: Corrects headline

Updated on Tuesday, September 22, 2020 5:06 PM CDT: Comments added, new headline.