How low can it go? Downtown Bay appraised at $0

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for 4 weeks then price increases to the regular rate of $19.00 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.75/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 20/11/2019 (2216 days ago), so information in it may no longer be current.

Quick quiz.

Guess which of the 79 buildings the Hudson’s Bay Co. owns in its multibillion-dollar real estate portfolio is practically worthless?

Of course you know the answer. It’s The Bay’s iconic flagship store in downtown Winnipeg.

Cushman & Wakefield conducted an extensive technical appraisal of the company’s properties as part of a lengthy corporate transaction that’s in the works to take the company private. It concluded what many in Winnipeg already understand to be the case — the Portage Avenue building is not worth anything… $0.00 to be exact, according to Cushman & Wakefield.

It’s likely worth less because it carries a $302,298 tax liability.

With 515,523 square feet of leaseable space, it is also one of the largest in a portfolio that includes at the top end the Saks Fifth Avenue flagship store in New York, which, at 493,911 square feet, is valued at $1.6 billion.

The appraisal also estimates values if the buildings were to be leased to a third party or multiple third parties, but it doesn’t get much better for what was once a mighty symbol for downtown commerce.

The appraisal suggests that with $91 million of improvements for a single tenant it might be worth $8 million, or with $111 million of investment for multi-tenants it might be worth $10.8 million.

A couple of senior Winnipeg real estate professionals said rental rates suggested in the appraisal are too high and the investment required to bring it up to market conditions is far too low.

And to top it off, the building received heritage designation earlier this year, which included some interior elements, so it cannot be demolished.

“Would you take that building if someone said you could have it for a dollar? I don’t know if I would,” asked Rennie Zegalski, principal at Capital Commercial Real Estate Services Inc. in Winnipeg.

The Bay currently operates out of two of the six floors of the building. Even Cindy Tugwell, executive director of Heritage Winnipeg which championed the heritage status, understands it’s not worth much as a retail enterprise.

“It has to be a huge liability for The Bay,” she said. “The operating costs far surpass the revenue they generate. It has become a liability to them.”

It does not take a retail industry expert to know that large format department stores are a thing of the past and there have been many schemes suggested over the years to try to figure out a viable plan to re-purpose the building. But none of them could be configured to work.

“Many really smart people have tried to make sense of this property for decades,” said John Pearson, president of ICI Properties at Shindico. “That includes the (University of Winnipeg), Manitoba Hydro and several government entities. Our firm was part of that… trying to find some use for the property for the future. All of those entities vetted and hugely researched the situation to try to find some value in it. In our opinion the building is at the end of its useful life.”

Pearson’s assessment is probably the consensus at this point. Redevelopment proposals have dried up over the past few years.

Kate Fenske, president of the Downtown BIZ, laughed when she heard the appraisal.

“It just doesn’t get any easier,” she said.

But she said that what happens across the street at Portage Place, which is about to come under new ownership, may have some impact on The Bay property.

Real estate professionals will say property appraisals can be a moving target depending on the motivation — either to jack up the value for the benefit of current owners or depress it for the benefit of a purchaser.

But most Winnipeggers will see it for what it is.

“The long and short of it is the valuation certainly indicates what the community and what those who have been interested in developing it have said for a very long time,” said Angela Mathieson, the CEO of CentreVenture.

One real estate professional said that demolition, were it even possible, would likely cost more than the actual value of the land.

“It is a huge clunker,” said the veteran Winnipeg real estate professional who asked that his name not be used.

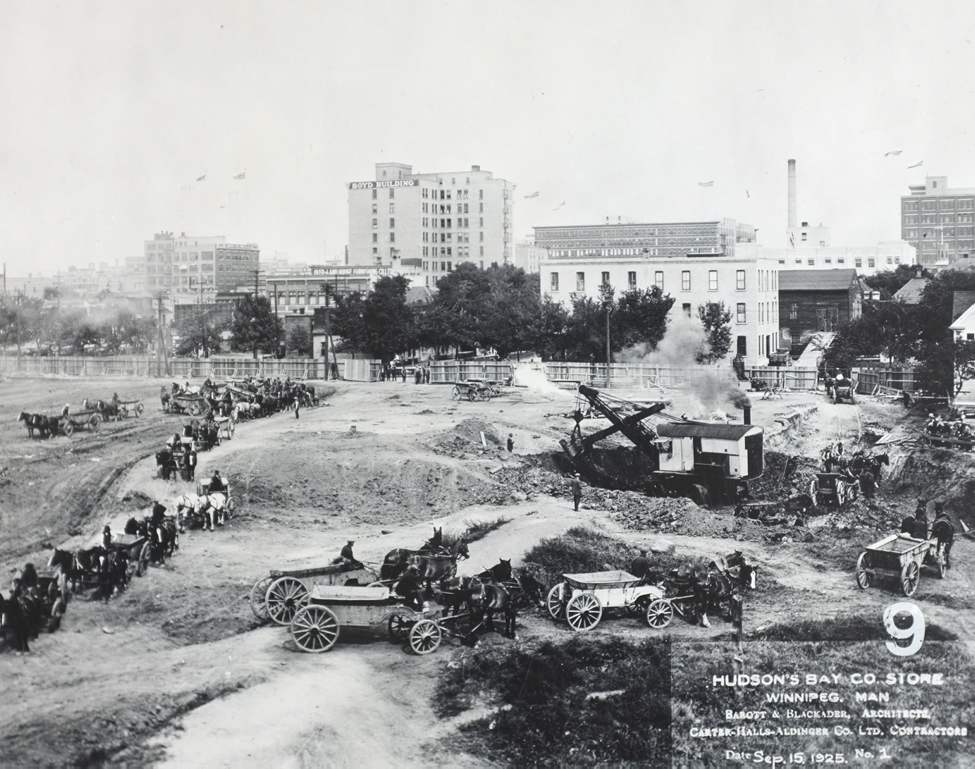

Redevelopment would be a massive expense with such huge floor plates and massive steel and concrete infrastructure. At the time it opened on Nov. 18, 1926, it was the largest reinforced concrete building in Canada.

“There are not enough windows, the HVAC is the sh-ts,” he said. “You probably need to knock it down and turn that land into something else.”

martin.cash@freepress.mb.ca

Martin Cash has been writing a column and business news at the Free Press since 1989. Over those years he’s written through a number of business cycles and the rise and fall (and rise) in fortunes of many local businesses.

Our newsroom depends on a growing audience of readers to power our journalism. If you are not a paid reader, please consider becoming a subscriber.

Our newsroom depends on its audience of readers to power our journalism. Thank you for your support.

History

Updated on Thursday, November 21, 2019 10:49 AM CST: corrects titles